By DAVID GITAU

Kenya’s tea industry, one of the world’s largest exporters, has become a hotbed for political and economic dispute over the growing divide between farmers in the East and West of the Rift Valley.

Farmers in regions like Mt. Kenya and the broader Eastern Rift are seeing better payouts and bonuses at the Mombasa tea auction compared to their counterparts in the western regions of Kenya, including Kericho, Bomet, and parts of the Rift Valley.

The disparity has prompted accusations of mismanagement, unfairness, and even corruption within the Kenya Tea Development Agency (KTDA), the body that oversees much of the country’s smallholder tea production.

However, while the political backlash is understandable, the reality is far more complex. The difference in prices at auction can be largely explained by a combination of factors: the perceived quality of the tea, regional variations in climate, production practices, and the broader dynamics within the tea market.

It is not simply a case of mismanagement or bias as some claim, but a reflection of deeper market forces and the inherent challenges in producing tea across a diverse landscape.

At the heart of the price gap is the fundamental difference in the quality of tea produced in the East and West of the Rift Valley.

The tea auction in Mombasa, where much of Kenya’s tea is

traded, is highly competitive. Buyers, primarily from international markets, are willing to pay a premium for tea that meets strict standards of quality.

Tea from the East of the Rift, particularly from the Mt. Kenya region, is highly sought after because it tends to have superior flavour and aroma, characteristics that are prized in the global market.

The key factor behind this quality disparity is geography. The Eastern Rift region, which includes the famous highlands of Mt. Kenya, benefits from a combination of cool temperatures, high

altitudes, and ample rainfall—conditions that are ideal for producing high-quality tea.

These cooler climates allow for slowergrowth, resulting in tender leaves that yield a more fragrant, full-bodied liquor.

Tea from the East is typically brighter, more robust, and more

aromatic, making it a preferred choice for blending with teas from other regions, particularly in markets like Pakistan, the Middle East, and the UK.

On the other hand, the Western Rift, which includes regions such as Kericho, Bomet, Kisii, and Bungoma; experiences warmer temperatures and lower altitudes, which tend to produce tea that is less vibrant and aromatic.

While tea from the West is still of good quality, it lacks the consistency in flavour and fragrance found in the East, meaning it often doesn’t fetch the same premium prices at the Mombasa auction.

Another factor contributing to the price gap is the way tea is produced in each region. The plucking process is central to the quality of the tea leaves, and this is where there is a marked

difference between the East and West.

In the Eastern region, farmers are more likely to adhere to the standard practice of plucking only the tender “two leaves and a bud”—the freshest, most flavourful parts of the tea plant.

Consistent adherence to this practice ensures that the tea maintains its high quality, which, in turn, ensures it attracts higher bids at auction.

Conversely, farmers in the West tend to focus more on high-volume production, which often leads to less selective plucking.

This can result in a mix of older, tougher leaves, which diminish the overall quality of the tea. As a result, while the West of Rift produces large quantities of tea, the overall quality does not match that of the East, which directly impacts its price at auction.

Beyond the quality of the tea itself, broader market dynamics also play a crucial role in the price differences. The KTDA has pointed out that carry-over stocks from previous seasons are a key issue for the Western Rift.

After a period of poor sales or high production volumes, factories in the West often find themselves with large quantities of unsold tea.

When the auction season resumes, these factories are often forced to sell their surplus tea at lower prices in order to clear their inventory, which can drag down the overall prices for all tea from the region.

At the same time, the volatility of the international tea market also contributes to this disparity. Factors like shifting demand, fluctuations in global supply chains, and the influence of currency exchange rates all affect the prices paid for tea at auction.

The East of Rift, with its higher quality tea, tends to fare better during these uncertain market conditions, attracting more consistent bids from buyers.

The West, on the other hand, with its less consistent offerings, faces more erratic price changes, exacerbating the price

difference.

While climate and production factors are key, structural issues within the tea industry cannot be ignored. Accusations of corruption and mismanagement within the KTDA have long plagued the sector, with critics claiming that the agency’s auction system is opaque and unfair.

The Western Rift, in particular, has seen accusations that local brokers and private factory owners deliberately depress prices to encourage farmers to sell their tea outside the KTDA system.

These practices, they claim, are part of a broader network of market manipulation that disproportionately affects farmers in the West.

There are also concerns about the KTDA’s pricing mechanisms and the perceived lack of transparency in how prices are set and bonuses are distributed.

This lack of clarity has fuelled dissatisfaction among farmers in the West, who feel they are unfairly disadvantaged despite producing large quantities of tea.

The agency’s failure to address these concerns has only added fuel to the fire, further entrenching the belief that there is a systemic bias against the West of Rift.

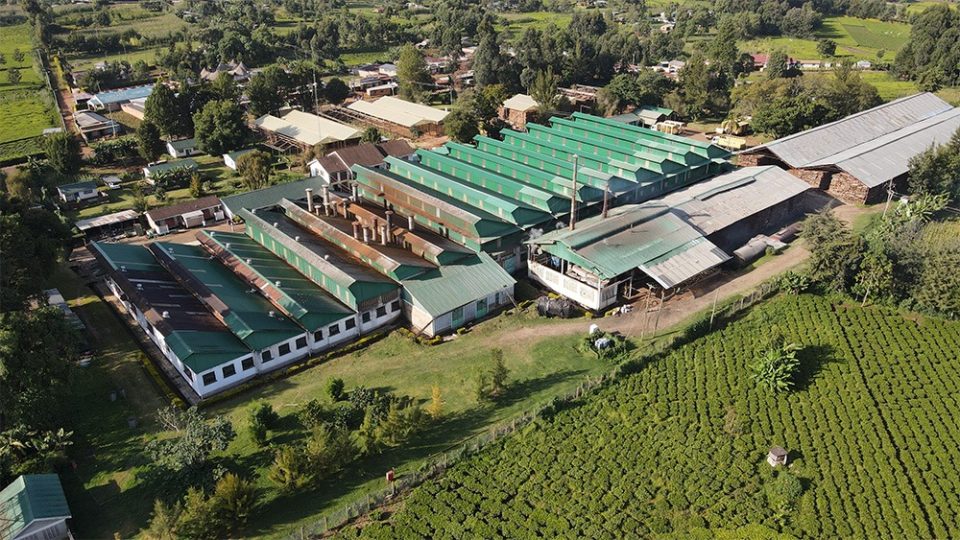

The cost of production also varies across regions. Factories in the Eastern Rift, particularly those close to major infrastructure hubs, have made significant investments in improving their

operational efficiency, such as by building their own power sources to reduce energy costs.

These investments not only help reduce the cost of production but also allow for higher payments to farmers, further incentivising them to produce high-quality tea.

In contrast, some factories in the Western Rift, particularly those located in more remote areas, face higher production costs.

These factories often struggle with infrastructure limitations and higher energy costs, which makes it harder for them to offer competitive prices to farmers.

As a result, the overall quality of tea from the West is affected, and the price paid to farmers is lower.

Kenya’s tea sector is highly export-dependent, and as such, international market demand plays a significant role in determining the prices paid at the Mombasa auction.

Countries like Pakistan, the Middle East, and the UK are major buyers of Kenyan tea, and their changing preferences can

directly influence the prices at auction.

In addition, fluctuations in exchange rates, particularly the weakness of the Kenyan Shilling against the US Dollar, have impacted the overall value of tea, further squeezing farmers in the West of Rift who rely on KTDA’s payouts.

The disparity in tea prices between the East and West of Rift Valley is a multifaceted issue.

While climate and production practices are the primary drivers of the price difference, structural inefficiencies within the tea sector and the KTDA’s lack of transparency add another layer of complexity.

Farmers in the West of Rift may have legitimate grievances, but these are not solely due to mismanagement. Instead, they reflect deeper, more systemic issues that need to be addressed in order to ensure fairness and improve the competitiveness of Kenya’s tea industry.

Reforms within the KTDA, clearer payment timelines, and greater transparency in the auction process could help level the

playing field.

But until these changes are made, the divide between the East and West will remain, with tea from the East continuing to command a premium at the Mombasa auction; thanks to its inherent quality and the global demand for

top-tier Kenyan tea.